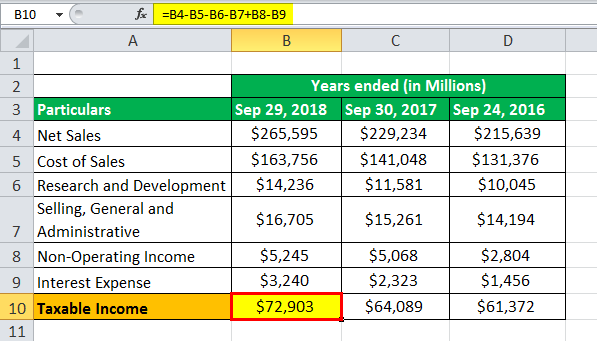

taxable income malaysia 2017

Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of RM2500 yearly also includes new categories such as the purchase of printed. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

. Malaysia is also planning to introduce a special scheme for the 2017 and 2018 years of assessment that provides for a reduction of the standard income tax rate on the year-on-year. Calculations RM Rate TaxRM 0 - 2500. The following income categories are exempt from income tax.

Confused About US Expat Taxes. For chargeable income in excess of MYR 500000 the corporate income tax rate is 25. On the First 2500.

Up to RM5000. MYR 5 per person. 12 October 2017 DIRECTOR.

On the First 5000 Next 5000. RM 770 If the above is still not paid after 60 days you will be charged another 5 on the RM770 making your total tax payable come up to RM 80850. A taxable supply is either.

RM35000 - RM50000. Income range Malaysia income tax rate 2017. INLAND REVENUE BOARD OF MALAYSIA TAX ON INCOME OF A NON-RESIDENT PUBLIC ENTERTAINER Public Ruling No.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. I standard-rated current tax rate is 6. Ad Report All Foreign Income To IRS Correctly With Most Accurate Tax Software For US Expats.

Examples of such supplies are local supply of goods and services such as sale of commercial properties and furniture. A for a person carrying on a business the Guidelines apply wholly to a business with gross income exceeding RM25 million and the total amount of related party transactions exceeding. Leasing income from moveable property derived by a permanent establishment in Malaysia is taxed.

41 Residence status for income tax purposes Residence status is a question of fact and is one of the main criteria that determines an individuals liability to Malaysian income tax. Rental Income of a REITPTF -Special Tax Treatment The Government had introduced a special tax treatment as an incentive to promote the growth of REITPTF in Malaysia effective year of. Access Top US Expat Tax Service In Minutes.

Income Tax Exemption No. ARE THERE ANY PARTICULAR TAX ISSUES TO CONSIDER IN THE ACQUISITION BY FOREIGN COMPANIES. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Income MYR 5000. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia. RM20000 - RM35000.

Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors. INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART II QUALIFYING EXPENDITURE FOR PURPOSES OF CLAIMING ALLOWANCES. 62017 Date Of Publication.

Malaysia Personal Income Tax Rate. A qualified person defined who is a knowledge. 1 Leave Passage Vacation time paid for by your employer in two categories.

9 Order 2017 The above order gazetted on 24 October 2017 exempts a NR from payment of tax on income under sections 4Ai ii which is rendered. Malaysia does not impose withholding tax on dividends. Total tax payable.

RM5000 - RM20000.

Malaysia Bracing For Taxation Of Foreign Sourced Income

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

Personal Income Tax Progressivity Trends And Implications1 In Imf Working Papers Volume 2018 Issue 246 2018

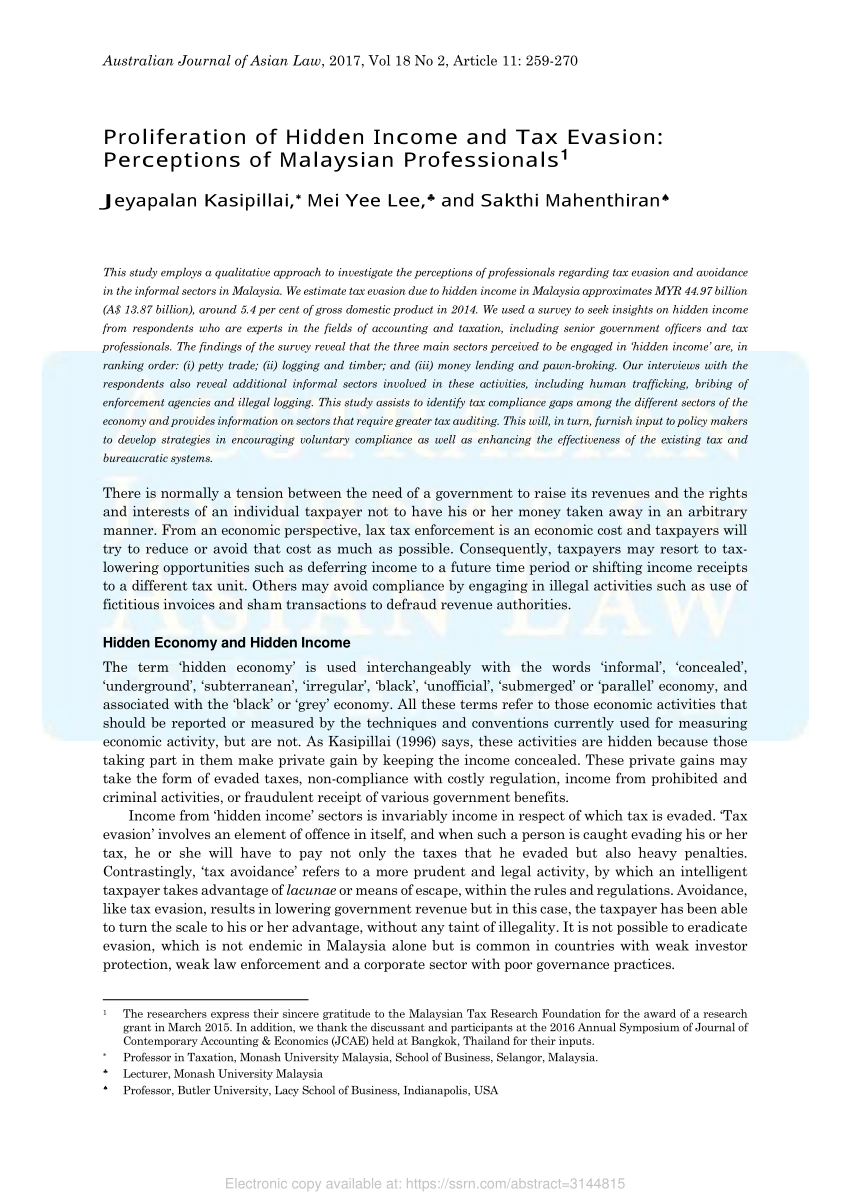

Pdf Proliferation Of Hidden Income And Tax Evasion Perceptions Of Malaysian Professionals

Which U S Companies Have The Most Tax Havens Infographic

The Purpose And History Of Income Taxes St Louis Fed

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical Insurance Read This Ibanding Making Better Decisions

Courtesy Withholding What You Don T Know Can Hurt You

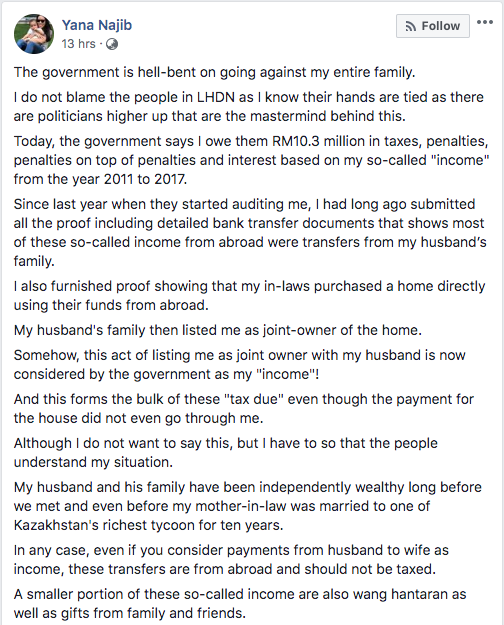

Former Pm S Daughter Shocked At Income Tax Bill Says Money Comes From Rich In Laws Laments Meritocracy

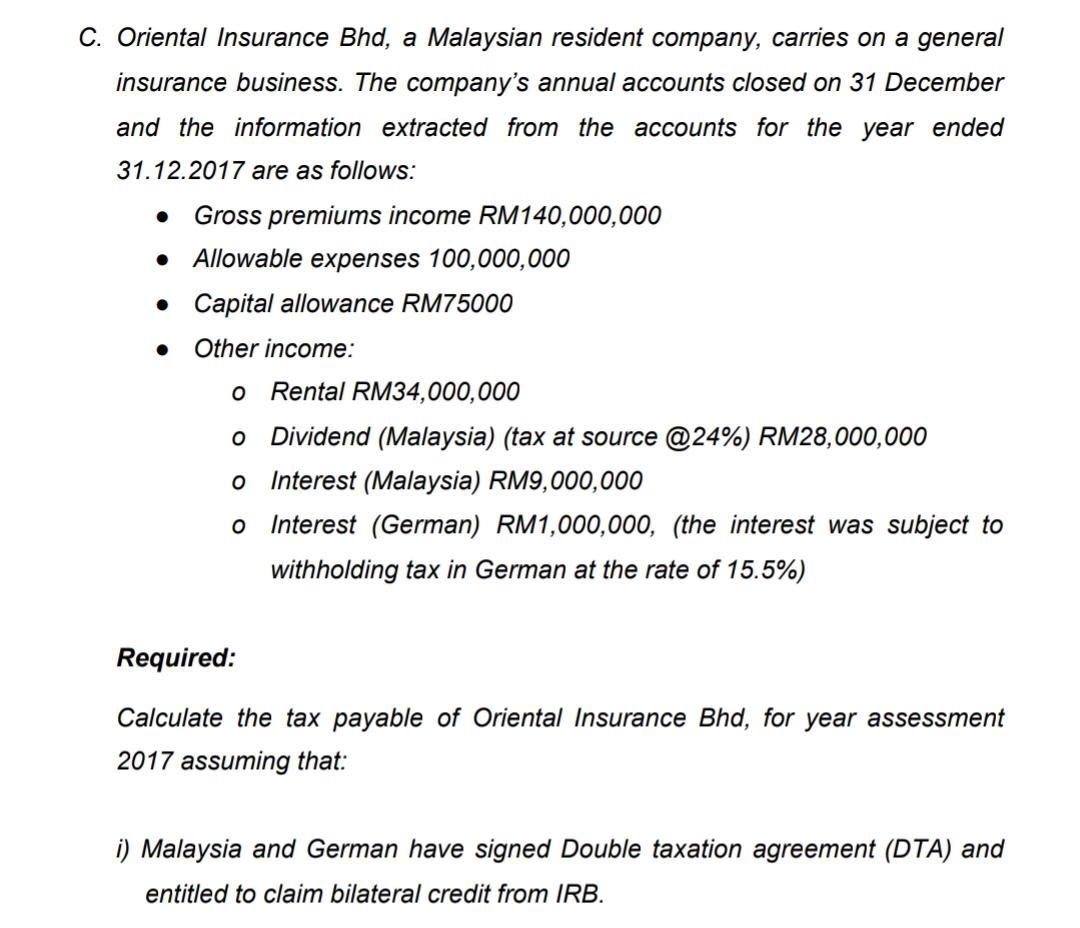

C Oriental Insurance Bhd A Malaysian Resident Chegg Com

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Malaysian Taxation 101 Inheritance Tax And You Secure Your Seat Now Https Goo Gl M4jgpr Is Inheritance Tax A Fact Or Myth Richard Oon 25 Years Experience In Taxation Is Going To Share

Paying 2017 2018 Income Tax In Malaysia Read This Wise Formerly Transferwise

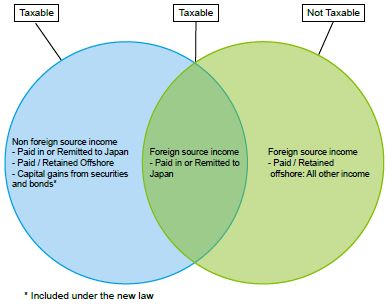

Change In Taxation Of Non Permanent Residents Tax Authorities Japan

What Are The Sources Of Revenue For State Governments Tax Policy Center

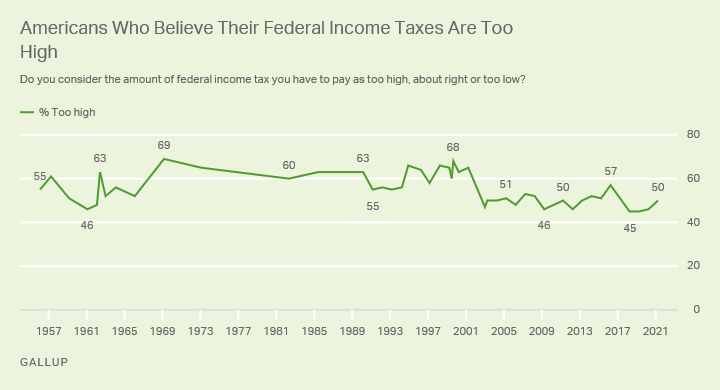

What S Driving Americans Views Of Their Taxes

United States Taxation Of Cross Border M A Kpmg Global

0 Response to "taxable income malaysia 2017"

Post a Comment